Top Colocation Providers Comprehensive Comparison

In an era dominated by discussions of public cloud, a powerful and resilient segment of the digital infrastructure market continues to thrive: colocation. Colocation, or “colo,” provides organizations with secure physical space, power, cooling, and bandwidth within a third-party data center, offering the control of owning infrastructure with the flexibility and economies of scale of a managed facility. As businesses grapple with data sovereignty, latency requirements, and the limitations of a purely cloud-native approach, selecting the right colocation partner has become a critical strategic decision. This in-depth analysis provides a comprehensive comparison of the world’s leading colocation providers, examining their unique strengths, global footprints, service specializations, and the key differentiators that can guide enterprises toward the optimal choice for their specific operational needs.

A. The Colocation Resurgence: Why It Remains a Critical Infrastructure Pillar

The narrative that everything is moving to the cloud is incomplete. Colocation is experiencing a renaissance, driven by several powerful market forces.

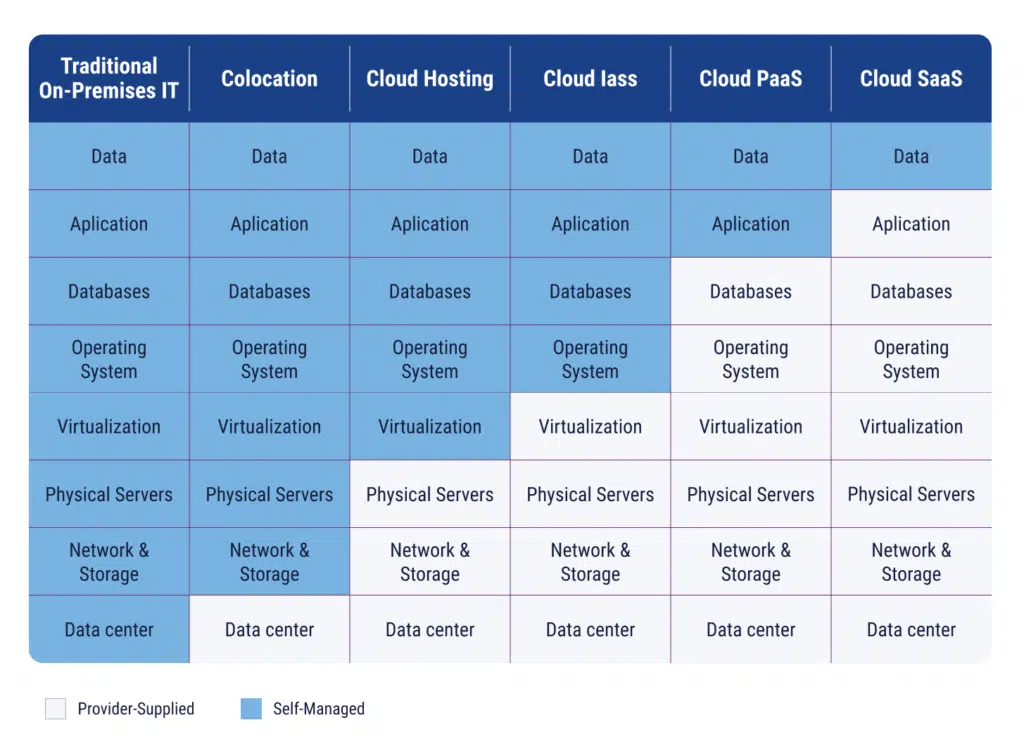

A. Hybrid Cloud and Multi-Cloud Strategy Implementation:

Most enterprises are adopting a hybrid approach, blending public cloud with private infrastructure. Colocation data centers serve as the perfect neutral ground, allowing businesses to host their private servers, storage, and networking gear while establishing low-latency, high-bandwidth connections directly to major cloud providers like AWS, Azure, and Google Cloud through cloud on-ramps.

B. Data Sovereignty and Regulatory Compliance:

Stringent regulations like GDPR in Europe and various national data protection laws require that certain data be stored and processed within specific geographic boundaries. Colocation providers with a global footprint offer local facilities that ensure compliance, avoiding the legal complexities of storing data in a public cloud region located in another country.

C. Performance and Latency Sensitivity:

For applications where milliseconds matter—such as high-frequency trading, online gaming, and real-time data analytics—physical proximity to users, partners, or financial exchanges is non-negotiable. Colocation facilities in strategic network hubs provide this essential low-latency advantage.

D. Cost Predictability and Control:

While the cloud offers flexibility, its variable costs can spiral out of control due to data egress fees and resource consumption. Colocation provides predictable monthly costs for space and power, offering financial stability for steady-state, predictable workloads. This CapEx/OpEx hybrid model provides long-term cost advantages for dense, high-performance computing.

B. Evaluating the Titans: A Deep Dive into Leading Providers

The global colocation market is dominated by a few key players, each with a distinct strategy and market focus.

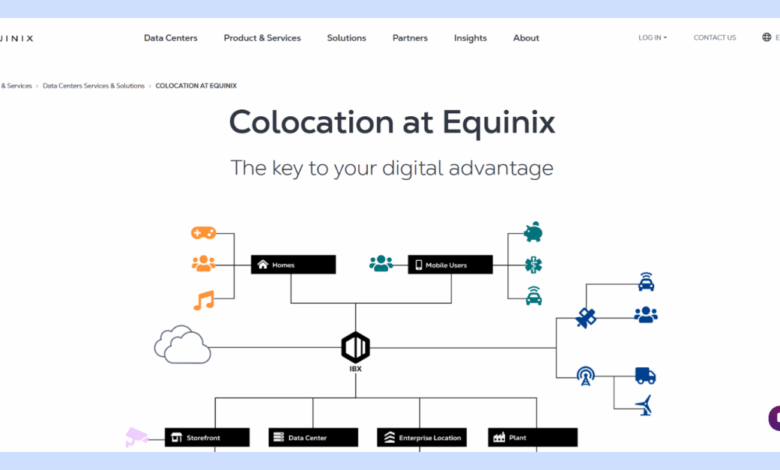

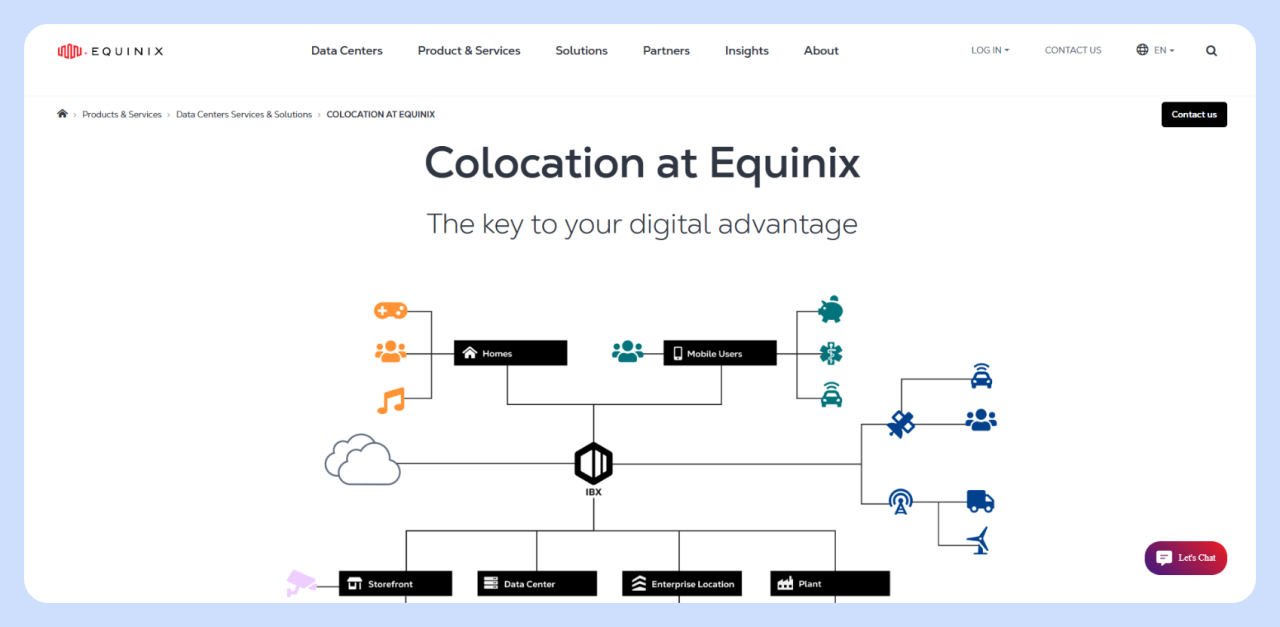

A. Equinix: The Interconnection Powerhouse

Equinix is the undisputed leader in interconnection-centric colocation, operating more than 260 International Business Exchange (IBX) data centers across over 70 metros.

-

Core Differentiation: Its flagship service, Equinix Cloud Fabric, and the broader Equinix Platform are designed for digital ecosystem integration.

-

Strengths:

A. Massive Ecosystem: Access to thousands of networks, cloud providers, and IT service providers within the same facility.

B. Interconnection Services: Industry-leading capabilities for cross-connects, enabling private, high-performance data exchange between businesses.

C. Global Consistency: A uniform operating model and platform across all its global locations. -

Ideal For: Financial services firms, multinational enterprises, and any business whose strategy depends on seamless interconnection with partners, clouds, and customers.

-

Considerations: Typically commands a premium price compared to retail colocation providers focused purely on space and power.

B. Digital Realty: The Scale and Footprint Leader

With a massive portfolio following its merger with Interxion, Digital Realty offers unparalleled global scale, catering to both large enterprises and hyperscale clients.

-

Core Differentiation: A vast footprint of massive data center campuses, particularly in key network hubs, supporting deployments from a single cabinet to multi-megawatt requirements.

-

Strengths:

A. Hyperscale Capability: Designed to support massive, power-dense deployments for the world’s largest tech companies.

B. Strategic Acquisitions: Its merger with Interxion solidified its dominance in the European market, providing deep connectivity.

C. ServiceFlex Offering: A flexible portfolio that allows customers to mix and match space, power, and interconnection services to meet specific needs. -

Ideal For: Large enterprises executing large-scale digital transformations, hyperscale companies, and organizations needing massive capacity in core global markets.

-

Considerations: The experience can vary more by location compared to Equinix’s highly standardized platform.

C. CyrusOne: The High-Density and Hyperscale Specialist

CyrusOne has built a reputation for engineering excellence, particularly in designing facilities that support extremely high power densities for sophisticated clients.

-

Core Differentiation: A focus on highly reliable, scalable data centers specifically engineered for power-intensive workloads from Fortune 1000 companies.

-

Strengths:

A. Power Density: Expertise in supporting high-density deployments (20kW+ per cabinet) that are common in HPC and AI workloads.

B. Speed to Market: Known for its ability to design and deliver large-scale, customized data hall solutions rapidly.

C. Customer-Centric Design: Its “Massively Modular” engineering approach ensures scalability and reliability. -

Ideal For: Technology companies, cloud providers, and enterprises with high-performance computing needs that require robust power and cooling solutions.

-

Considerations: Its footprint, while significant, is more focused on key U.S. and European markets compared to the global sprawl of Equinix and Digital Realty.

D. NTT Global Data Centers: The Integrated Technology Giant

As part of the NTT communications conglomerate, NTT Global Data Centers offers a unique value proposition by combining world-class colocation with a full suite of managed and network services.

-

Core Differentiation: The ability to provide a fully integrated solution encompassing colocation, network connectivity, and managed IT services from a single vendor.

-

Strengths:

A. One-Stop Shop: Simplifies vendor management by offering networking, security, and cloud management services alongside colocation.

B. Global Network Backbone: Leverages the extensive NTT Communications global IP network, providing excellent inherent connectivity.

C. Strong SLAs: Offers robust, financially-backed service level agreements for both power and network availability. -

Ideal For: Enterprises looking to reduce vendor complexity and leverage a single provider for a broad range of ICT infrastructure needs.

-

Considerations: The tight integration with NTT’s own services may be less appealing to companies committed to a multi-vendor strategy.

C. Key Comparison Metrics: A Strategic Evaluation Framework

Choosing a provider requires a systematic evaluation across several critical dimensions.

A. Global Footprint and Geographic Strategy:

The provider’s location map must align with your business strategy.

-

Carrier-Dense Network Hubs: Providers like Equinix dominate in major interconnection points like Ashburn, Virginia (the “Data Center Alley”), Silicon Valley, Frankfurt, and Singapore.

-

Emerging Markets: Consider if you need presence in growing markets like South America, Southeast Asia, or the Middle East, where provider coverage varies.

-

Edge Locations: For latency-sensitive applications, evaluate the provider’s footprint in secondary cities closer to your end-users.

B. Power and Cooling Capabilities:

This is a fundamental technical differentiator.

-

Power Density: Can the facility support your current and future power requirements per cabinet? Standard is 5-10kW, but modern HPC and AI can require 30-50kW+.

-

Cooling Technology: Look for advanced, efficient systems like direct liquid cooling (DLC) or water-side economization that support high densities and reduce PUE.

-

Power SLA and Redundancy: Examine the details of the Service Level Agreement for power, typically 100% uptime, and the electrical architecture (N+1, 2N, etc.).

C. Connectivity and Interconnection Ecosystem:

This is often the most critical differentiator beyond basic space and power.

-

Network Neutrality: A truly carrier-neutral facility will host a large number of telecom carriers and internet service providers, giving you choice and driving down connectivity costs.

-

Cloud On-Ramps: Direct, private connections to major public clouds are essential for hybrid architecture. Evaluate the ease and cost of establishing these cross-connects.

-

Internet Exchanges: Presence of a major internet exchange (IX) within the building provides superior peering and low-latency internet access.

D. Security and Compliance Posture:

The provider’s security must meet your corporate and regulatory standards.

-

Physical Security: Multi-layered access control including biometrics, mantraps, 24/7/365 surveillance, and professional security personnel.

-

Logical Security: Advanced DDoS mitigation, network firewalling, and intrusion detection services offered as managed options.

-

Compliance Certifications: Look for independently audited certifications relevant to your industry, such as SOC 1/2/3, ISO 27001, PCI-DSS, HIPAA, and GDPR compliance.

D. The Procurement Process: A Step-by-Step Guide

Navigating the colocation selection and procurement process requires diligence and clear internal requirements.

A. Phase 1: Internal Needs Assessment:

Before speaking to vendors, you must have a clear picture of your own needs.

-

Define Technical Requirements: Calculate current and future needs for space (cabinets, cages), power (kW, kVA), cooling density, and cross-connects.

-

Establish Geographic and Latency Requirements: Determine the optimal location(s) based on user proximity, data sovereignty, and disaster recovery strategy.

-

Set Budgetary and Compliance Constraints: Understand your financial parameters and the mandatory compliance certifications.

B. Phase 2: Market Analysis and RFI/RFP Process:

-

Develop a Request for Information (RFI): Send a high-level questionnaire to a broad list of potential providers to narrow the field.

-

Issue a Detailed Request for Proposal (RFP): For your shortlisted providers (3-5), issue a detailed RFP with your specific technical, commercial, and legal requirements.

-

Conduct Site Visits: There is no substitute for visiting the shortlisted facilities to assess their operations, security, and cleanliness firsthand.

C. Phase 3: Contract Negotiation and SLAs:

-

Scrutinize the Service Level Agreement (SLA): Pay close attention to the definitions of uptime, outage credits, and exclusions. Negotiate for stronger terms if necessary.

-

Understand All Costs: Look beyond the monthly recurring charge (MRC) for setup fees, cross-connect fees, remote hands support fees, and potential overage charges.

-

Negotiate Flexibility: Ensure the contract allows for future expansion, reduction, or relocation of services without excessive penalties.

E. Future-Proofing Your Colocation Strategy

The colocation market is dynamic. A strategic partner should be evolving with the industry.

A. Sustainability and ESG Commitments:

Providers are under pressure to reduce their carbon footprint. Evaluate their commitment to Power Usage Effectiveness (PUE), Water Usage Effectiveness (WUE), and their use of renewable energy through Power Purchase Agreements (PPAs).

B. Support for Advanced Architectures:

The provider should have a roadmap for supporting next-generation technologies, including direct liquid cooling for AI workloads, robust connectivity for edge computing deployments, and seamless integration with software-defined networking (SDN).

C. The Rise of Platform-Based Colocation:

The industry is moving beyond physical space to offer digital platforms (like Equinix’s) that allow customers to manage their global infrastructure, connectivity, and cloud services through a single portal, representing the next evolution in managed infrastructure.

Conclusion: Making the Strategic Choice for Digital Growth

Selecting a colocation provider is one of the most consequential infrastructure decisions an enterprise can make. It is a long-term partnership that forms the bedrock of your digital operations. The choice is not about finding a universally “best” provider, but about finding the right provider whose strengths—be it unparalleled interconnection, global hyperscale capacity, engineering for high density, or integrated services—directly align with your company’s unique technical requirements and strategic business objectives. By conducting a thorough, metrics-driven evaluation and prioritizing a partner that can scale and innovate alongside your business, you can leverage colocation not just as a utility, but as a powerful strategic asset that enables agility, resilience, and competitive advantage in the digital economy.