Microserver Market Analysis and Growth Forecast

The global data center landscape is undergoing a profound architectural shift, moving beyond the one-size-fits-all approach of traditional rack servers. In an era defined by the exponential growth of scale-out workloads, edge computing, and intensifying pressure for energy efficiency, a specialized class of hardware is gaining significant traction: the microserver. Characterized by their low-power processors, high-density form factors, and cost-effective design, microservers are carving out a critical niche in the modern computing ecosystem. This comprehensive market analysis report delves into the key drivers, technological innovations, competitive landscape, and future trajectory of the global microserver market, providing strategic insights for IT decision-makers, investors, and technology enthusiasts navigating this dynamic segment.

A. Market Definition and Architectural Distinctions

To understand the microserver market, one must first distinguish it from the broader server industry.

A. What Constitutes a Microserver?

A microserver is a compact, shared-infrastructure server optimized for specific, lightweight workloads. Unlike general-purpose servers that use powerful, high-wattage processors to handle diverse tasks, microservers employ low-energy System-on-Chip (SoC) designs, often with multiple individual nodes packed into a single chassis or blade enclosure.

B. Key Differentiators from Traditional Servers:

-

Processor Architecture: Utilizes low-power CPUs (typically under 45W TDP) from ARM, Intel Atom, or AMD EPYC Embedded series, instead of high-performance Xeon or EPYC processors (145W+).

-

Form Factor and Density: Designed for extreme density, with chassis that can hold dozens or even hundreds of individual server nodes in a standard rack unit.

-

Shared Infrastructure: Nodes often share power supplies, networking, and management controllers within a single enclosure, reducing per-node cost and complexity.

-

Workload Specificity: Not designed for heavy lifting like database processing or virtualized environments, but excel at parallel, lightweight tasks.

B. Primary Market Drivers and Growth Catalysts

The microserver market is being propelled by several powerful, concurrent trends in the technology industry.

A. The Explosive Growth of Edge Computing:

The proliferation of Internet of Things (IoT) devices, 5G networks, and real-time analytics is pushing computation away from centralized cloud data centers to the network edge.

-

Requirements: Edge locations demand small, power-efficient, and ruggedized hardware that can operate in non-climate-controlled environments with minimal maintenance.

-

Microserver Fit: Their low power consumption, small physical footprint, and often fanless designs make them ideal for deployment in cell towers, retail stores, factories, and remote offices.

B. The Economic Imperative of Hyperscale Data Center Efficiency:

For cloud giants like Google, Meta, and Amazon, operational costs are dominated by power consumption. Microservers offer a path to significantly improved performance-per-watt for specific services.

-

Web Tier and Caching: Serving static web content, memcached, and Redis instances are perfect microserver workloads, allowing hyperscalers to run these services with minimal energy expenditure.

-

Containerized Microservices: The shift to container-based, cloud-native applications aligns perfectly with the microserver model of running many small, discrete processes.

C. The Maturation of ARM-based Server Processors:

The rise of viable ARM-based alternatives to x86 architecture has been a game-changer for the microserver segment.

-

Key Players: Ampere Computing, Amazon (with its Graviton processors), and Marvell are delivering ARM-based server chips with high core counts and exceptional power efficiency.

-

Benefits: The inherent RISC architecture of ARM often provides better performance-per-watt for scale-out workloads, directly challenging Intel’s and AMD’s dominance in the data center.

D. Sustainability and Green Computing Initiatives:

Corporate Environmental, Social, and Governance (ESG) goals are pushing organizations to seek energy-efficient IT infrastructure. Deploying microservers for appropriate workloads can significantly reduce a data center’s overall carbon footprint and power bill.

C. Key Market Segments and Workload Analysis

The microserver market is not monolithic; it is segmented by the specific workloads it is designed to optimize.

A. Web Hosting and Content Delivery Networks (CDNs):

This is the traditional and still-significant segment for microservers.

-

Use Case: Serving static web pages, images, and video streams for high-traffic websites and CDN nodes.

-

Rationale: These tasks are highly parallel and do not require powerful individual cores, making them ideal for the many-core, low-power microserver architecture.

B. Cloud-Native and Containerized Applications:

The modern software development paradigm is a powerful driver.

-

Use Case: Hosting lightweight Docker or Kubernetes containers for microservices-based applications.

-

Rationale: Each container can be assigned to a single microserver node, providing physical isolation, security, and predictable performance without the overhead of a hypervisor.

C. Cold Storage and Big Data Analytics:

Microservers are finding a role in large-scale, data-intensive computing.

-

Use Case: As storage nodes in massive object storage archives or for running map-reduce analytics jobs where tasks can be distributed across thousands of low-cost nodes.

-

Rationale: The low acquisition and operational cost of microservers makes them economically viable for storing and processing exabytes of data that are accessed infrequently.

D. Network Functions Virtualization (NFV):

The telecommunications industry is transforming its infrastructure.

-

Use Case: Running virtualized network functions like firewalls, load balancers, and session border controllers.

-

Rationale: Microservers provide the right balance of performance, density, and power efficiency for telecom operators deploying 5G core networks at the edge.

D. Technological Innovations and Architectural Trends

The underlying technology of microservers is evolving rapidly, enhancing their capabilities and expanding their addressable market.

A. Advanced System-on-Chip (SoC) Integration:

Modern microserver processors are true SoCs, integrating CPU cores, memory controllers, networking (including 25/100GbE), and PCIe lanes onto a single piece of silicon. This reduces motherboard complexity, cost, and power consumption.

B. Disaggregated and Composable Architectures:

The next frontier involves separating the core components of a server.

-

Concept: In a disaggregated rack, compute nodes (microservers), memory, and storage are separate resources connected via a high-speed fabric (like CXL – Compute Express Link).

-

Benefit for Microservers: This allows a pool of microserver compute nodes to dynamically access shared memory and storage resources, increasing utilization and flexibility beyond a fixed configuration.

C. Specialized Accelerators and Heterogeneous Computing:

Microservers are increasingly incorporating specialized silicon for specific tasks.

-

AI Inference: Adding low-power AI accelerators to microserver nodes enables real-time inference at the edge for applications like video analytics and natural language processing.

-

SmartNICs: Offloading networking, security, and storage functions from the main CPU to a SmartNIC further increases the efficiency of the microserver node for its primary workload.

E. Competitive Landscape Analysis

The microserver market features a diverse set of players, from silicon vendors to integrated system manufacturers.

A. Leading Silicon Providers:

-

Ampere Computing: A pure-play provider of high-performance ARM-based server processors, specifically targeting cloud and edge workloads with high core counts and consistent performance.

-

Intel: Responding with its Xeon-D and Atom P-series processors, which blend x86 compatibility with lower power envelopes suitable for microserver designs.

-

AMD: Offers its EPYC Embedded series, providing high core count and extensive I/O in a low-power package, competing in the performance segment of the microserver space.

-

Amazon Web Services (AWS): A unique vertically-integrated player, designing its own Graviton ARM-based processors and deploying them at massive scale within its cloud, indirectly validating the microserver model.

B. Key System Manufacturers:

-

Hewlett Packard Enterprise (HPE): With its Edgeline and ProLiant MicroServer lines, targeting the converged edge and small business markets.

-

Dell Technologies: Offers its PowerEdge XR series for ruggedized edge and military deployments, and microserver options for web hosting.

-

Supermicro: A leading provider of building-block solutions, offering a wide array of microserver chassis and boards based on both x86 and ARM architectures.

-

NVIDIA: While known for GPUs, its Jetson platform for edge AI represents a form of microserver, combining an ARM CPU with a GPU for accelerated computing at the edge.

F. Market Challenges and Restraint Analysis

Despite strong growth drivers, the microserver market faces significant headwinds.

A. The Performance Limitations for General-Purpose Workloads:

Microservers are not suitable for applications requiring high single-thread performance, large memory capacity per node, or high I/O bandwidth. This inherently limits their market penetration to a specific subset of workloads.

B. Software Ecosystem and Application Compatibility:

While improving, the ARM software ecosystem still lags behind the mature x86 environment. Porting legacy applications to ARM can require significant development effort, creating a barrier to adoption for some enterprises.

C. Competition from Virtualization and Containerization:

The ability to run hundreds of virtual machines or containers on a single, powerful traditional server can sometimes be more cost-effective and manageable than deploying a large number of physical microservers.

D. Economic Viability and Total Cost of Ownership (TCO) Questions:

The acquisition cost of a single microserver node may be low, but the TCO calculation must include the management overhead of hundreds or thousands of individual nodes, as well as the cost of the shared chassis and infrastructure.

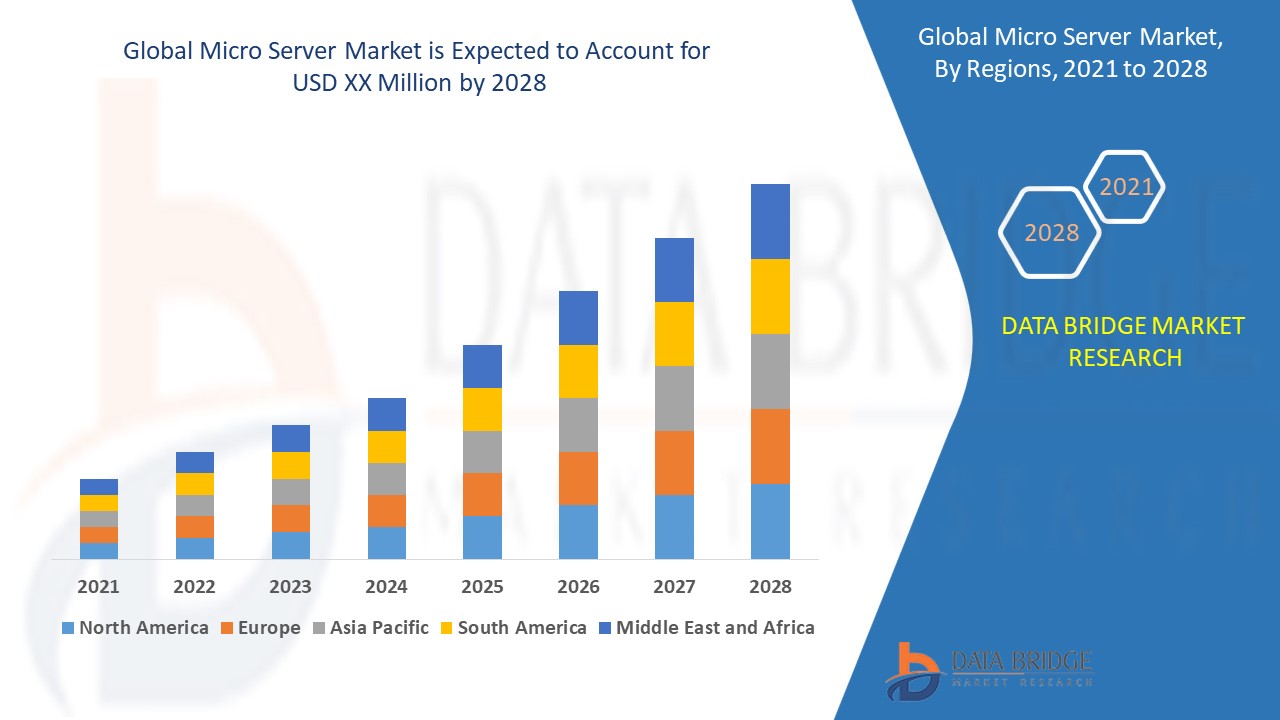

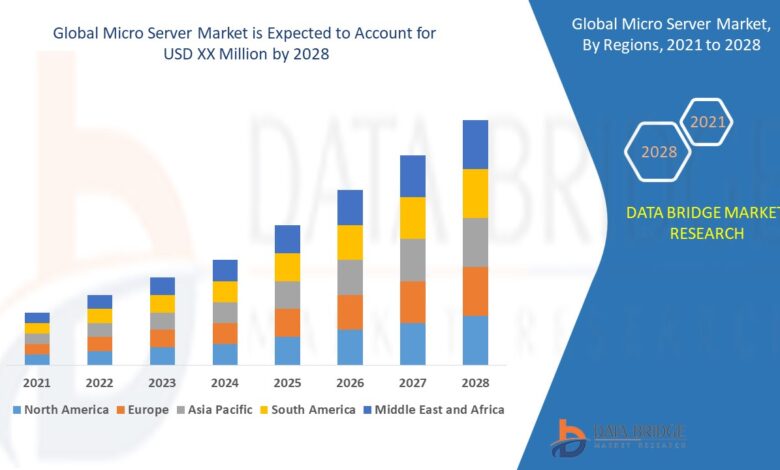

G. Regional Market Analysis and Adoption Patterns

Adoption of microserver technology varies significantly across different geographic regions.

A. North America:

The largest market, driven by early adoption from hyperscale cloud providers and technology companies. Strong investments in edge computing and 5G infrastructure are fueling further growth.

B. Asia-Pacific:

The fastest-growing region, propelled by massive data center construction in China, India, and Southeast Asia. The presence of major electronics manufacturers and a strong push for digitalization are key factors.

C. Europe:

Steady growth, driven by stringent data sovereignty laws (GDPR) that encourage localized edge data centers and a strong focus on green technology and energy efficiency.

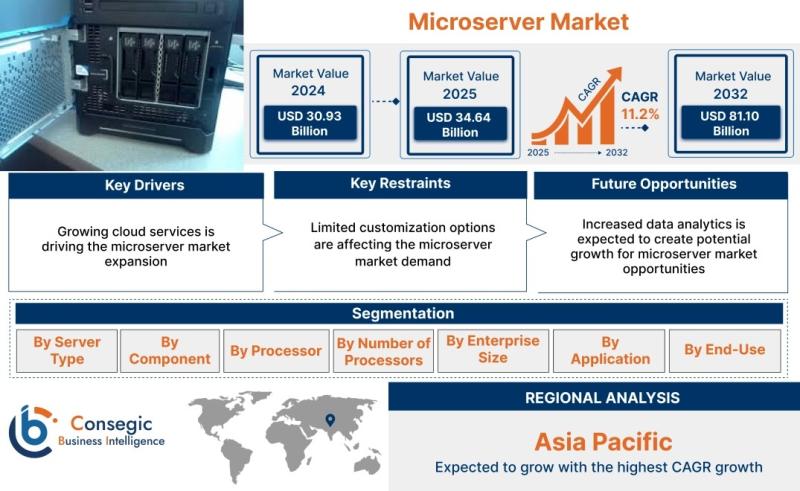

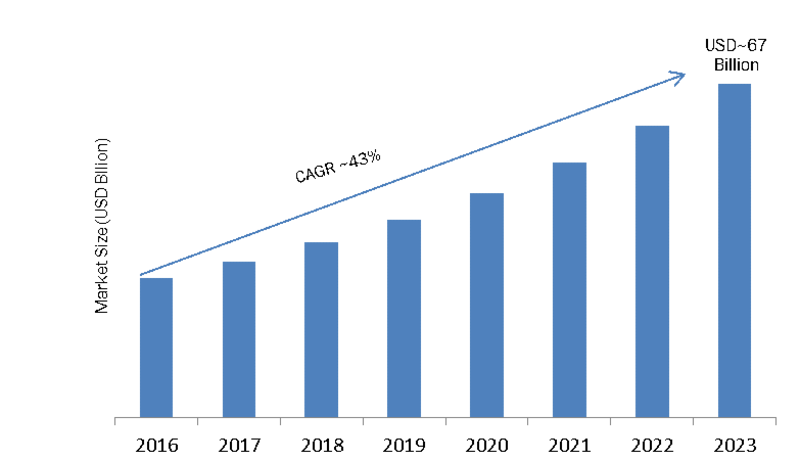

H. Future Market Outlook and Forecast (2024-2030)

The microserver market is poised for robust growth, with several key trends shaping its future.

A. Market Consolidation and Specialization:

We anticipate consolidation among smaller players and increased specialization, with vendors focusing on vertical-specific microserver solutions for telecom, industrial IoT, and healthcare.

B. The Proliferation of AI-at-the-Edge:

Microservers will increasingly be sold as integrated systems with built-in AI accelerators, becoming the default compute platform for smart cities, autonomous retail, and predictive maintenance in manufacturing.

C. The Maturation of Composable Disaggregated Infrastructure (CDI):

As technologies like CXL become mainstream, the microserver will evolve from a fixed-form appliance to a dynamic pool of composable compute resources, dramatically increasing its utility and efficiency in the data center.

D. Price-Performance Breakthroughs:

Continued innovation in semiconductor process technology (3nm, 2nm) and chiplet architectures will deliver successive generations of microservers with dramatically improved performance per watt and total cost of ownership.

Conclusion: A Strategic Niche Becomes Mainstream

The microserver is no longer a fringe concept but an essential component of a modern, heterogeneous data center strategy. Its value proposition is undeniable for the scale-out, edge-native, and containerized workloads that define the next chapter of digital transformation. While challenges around software ecosystems and TCO remain, the relentless trends of edge computing, sustainability, and ARM processor advancement provide powerful, sustained momentum. For organizations seeking to optimize their infrastructure for efficiency, density, and distributed intelligence, the strategic integration of microservers is no longer an option—it is a competitive imperative. The market is on a clear trajectory, and microservers are set to become the ubiquitous, silent workhorses powering the intelligent edge and the efficient cloud of the future.