Hardware-as-a-Service Market Expansion Analysis

The traditional model of enterprise technology procurement—large capital expenditures for hardware that rapidly depreciates and becomes obsolete—is undergoing a radical transformation. In its place, a flexible, subscription-based paradigm is experiencing explosive growth: Hardware-as-a-Service (HaaS). This operational model, where businesses pay a recurring fee for their devices and associated services rather than purchasing them outright, is reshaping how organizations of all sizes manage their IT infrastructure. From laptops and workstations to servers and networking equipment, HaaS is becoming the default choice for forward-thinking enterprises. This comprehensive analysis explores the powerful drivers behind the HaaS market expansion, its multifaceted benefits, the key players and offerings, implementation challenges, and the future trajectory of this transformative approach to technology consumption.

A. Deconstructing Hardware-as-a-Service: Beyond a Simple Lease

To understand the HaaS growth story, one must first move beyond the misconception that it is merely a fancy leasing agreement.

A. The Core Components of a True HaaS Model:

A comprehensive HaaS solution bundles several critical elements into a single, predictable monthly payment:

-

The Physical Hardware: The latest laptops, desktops, servers, or networking gear.

-

Lifecycle Management Services: Includes initial configuration, deployment, ongoing maintenance, and troubleshooting.

-

Proactive Support and Help Desk: Often featuring guaranteed SLAs for response and resolution times.

-

End-of-Life Services: Secure data wiping, device refurbishment, and environmentally responsible recycling.

-

Technology Refresh Cycle: Automatic, scheduled replacement of hardware (typically every 3-4 years) to ensure access to modern technology.

B. The Fundamental Shift in Financial and Operational Paradigms:

HaaS fundamentally alters the relationship a business has with its technology.

-

From Capital Expenditure (CapEx) to Operational Expenditure (OpEx): This shift frees up capital, improves cash flow, and simplifies budgeting with predictable monthly costs.

-

From Asset Ownership to Service Consumption: The focus moves from managing a depreciating asset to consuming a utility that delivers a business outcome.

-

From Reactive Break-Fix to Proactive Management: The service provider has a vested interest in maintaining hardware health to reduce support costs, leading to more stable and reliable IT environments.

B. The Powerful Drivers Fueling Market Expansion

The rapid adoption of HaaS is not a random trend; it is a strategic response to several converging macroeconomic, technological, and cultural shifts.

A. The Universal Push for OpEx Flexibility and Financial Agility:

In an uncertain economic climate, CFOs and finance departments strongly prefer the predictability of OpEx over large, lump-sum CapEx outlays.

-

Cash Flow Preservation: HaaS conserves capital for strategic investments in R&D, marketing, and core business operations.

-

Budget Predictability: A fixed monthly fee eliminates unexpected costs for repairs, replacements, and emergency hardware purchases.

-

Balance Sheet Optimization: Removes depreciating assets from the books, potentially improving financial ratios.

B. The Accelerating Pace of Technological Obsolescence:

The useful life of hardware is shrinking. A laptop purchased today may be inadequate for the software demands of three years from now.

-

Guaranteed Access to Innovation: HaaS contracts typically include a refresh cycle, ensuring employees always have hardware capable of running the latest, most productive software.

-

Performance and Security: Newer hardware often includes advanced security features (like hardware-based TPM chips) and better performance for modern, resource-intensive applications like AI-powered tools.

C. The Rise of Remote and Hybrid Work Models:

The distributed workforce has created immense logistical challenges for IT departments.

-

Simplified Logistics: A HaaS provider can ship pre-configured, secure devices directly to employees anywhere in the world.

-

Standardization and Security: Ensures a consistent, secure hardware baseline across the entire organization, regardless of an employee’s location, simplifying policy enforcement and management.

D. The Intensifying Focus on Sustainability and Circular Economy:

Corporate ESG (Environmental, Social, and Governance) goals are a major catalyst.

-

Reduction of E-Waste: HaaS providers are experts in the “3 Rs”—Repair, Refurbish, and Recycle. They extend the life of hardware through refurbishment and ensure responsible recycling, directly reducing the company’s environmental footprint.

-

Sustainable Sourcing: Many providers prioritize sourcing hardware from manufacturers with strong environmental credentials.

E. The Deepening IT Skills Gap:

Many organizations lack the in-house expertise to manage the full hardware lifecycle efficiently.

-

Access to Specialized Expertise: HaaS bundles the cost of expert lifecycle management, from deployment to disposal, into the subscription, filling a critical skills gap.

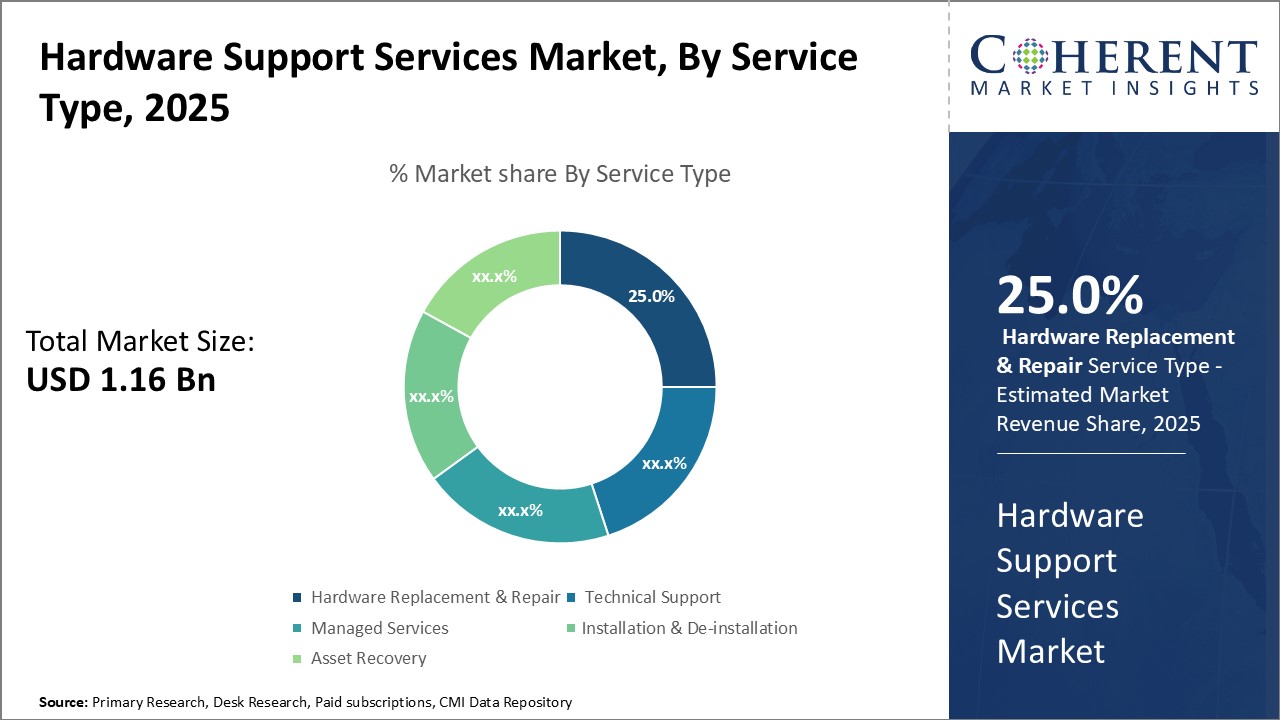

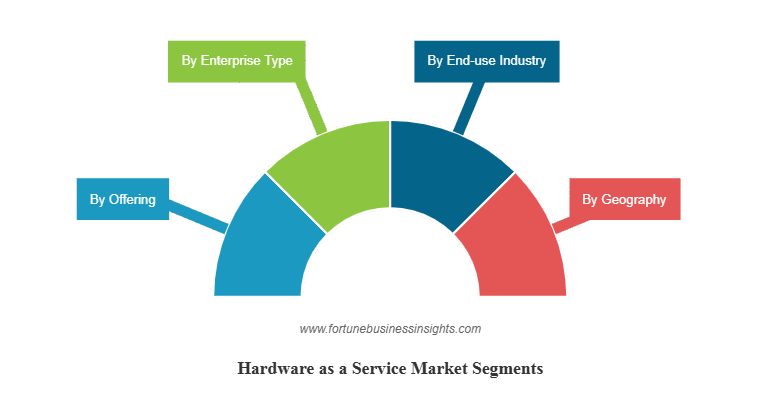

C. A Deep Dive into HaaS Product Categories

The HaaS model is being applied across the entire spectrum of enterprise hardware.

A. PC-as-a-Service (PCaaS):

This is the most mature and widely adopted segment of the HaaS market.

-

Scope: Encompasses laptops, desktops, tablets, and associated peripherals.

-

Value Proposition: Bundles the device, Microsoft 365 or Google Workspace licenses, endpoint security software, and support into one monthly invoice. Providers like HP, Dell, and Lenovo are major players.

B. Device-as-a-Service (DaaS) for the Internet of Things (IoT):

A specialized and rapidly growing segment for deploying and managing IoT sensors and edge devices at scale.

-

Scope: Includes sensors, gateways, and edge computing devices.

-

Value Proposition: Manages the logistical nightmare of deploying thousands of devices globally, including cellular connectivity, remote monitoring, and device health management.

C. Network-as-a-Service (NaaS):

Extending the HaaS model to core networking infrastructure.

-

Scope: Includes switches, routers, firewalls, and wireless access points.

-

Value Proposition: Provides always-up-to-date network security and performance without the burden of managing complex network hardware refreshes and firmware updates.

D. Server and Data Center Infrastructure HaaS:

Even core data center components are moving to a service model.

-

Scope: Includes compute servers, storage arrays, and hyperconverged infrastructure (HCI).

-

Value Proposition: Allows businesses to run a private cloud without the capital investment and 3-5 year commitment, with the ability to scale up or down as needs change.

D. The Tangible Business Benefits: A Compelling ROI Story

Adopting HaaS delivers measurable advantages across financial, operational, and strategic dimensions.

A. Total Cost of Ownership (TCO) Reduction:

While the monthly fee is visible, the true savings are in the hidden costs it eliminates.

-

Elimination of Hidden Costs: HaaS includes costs often overlooked in TCO calculations: procurement time, imaging and configuration, spare part inventory, repair labor, disposal fees, and the productivity loss during downtime.

-

Improved IT Staff Productivity: Frees up internal IT staff from mundane hardware tasks, allowing them to focus on strategic projects that drive business value.

B. Enhanced Security and Risk Mitigation:

-

Guaranteed Compliance: Regular refresh cycles ensure hardware can support the latest security protocols and operating systems, closing critical vulnerability gaps.

-

Secure Disposal: Providers guarantee certified data destruction at end-of-life, mitigating the risk of a data breach from improperly disposed equipment.

C. Unparalleled Scalability and Business Agility:

-

Elasticity: Hardware can be scaled up or down quickly to support business growth, new hires, or project-based needs without complex procurement processes.

-

Mergers and Acquisitions: Simplifies the IT integration process during M&A activity by quickly standardizing the acquired company’s hardware onto the HaaS platform.

E. Navigating the Challenges and Considerations

Despite its benefits, a successful HaaS implementation requires careful planning and vendor selection.

A. The Long-Term Financial Commitment:

HaaS contracts typically span 3-4 years. Exiting a contract early can be difficult and costly, making it crucial to choose a reliable partner and accurately forecast long-term needs.

B. Data Security and Privacy Concerns:

Since the provider owns the hardware, businesses must ensure the contract has ironclad clauses regarding data ownership, privacy, and security protocols, especially for devices that leave the corporate network.

C. Vendor Lock-In and Standardization:

Committing to a single vendor’s ecosystem can limit future flexibility. It’s important to evaluate the provider’s technology roadmap and ensure their offerings will remain competitive.

D. The True Cost Comparison:

Organizations must conduct a meticulous TCO analysis comparing the all-in HaaS fee against the true, fully-loaded cost of internal hardware management over the same period to validate the financial benefit.

F. The Competitive Landscape: Key Players and Their Strategies

The HaaS market is a battleground involving traditional hardware OEMs, managed service providers (MSPs), and specialized players.

A. Traditional Hardware OEMs (Dell, HP, Lenovo):

These companies have aggressively moved into services to protect their hardware business and create recurring revenue streams. Their strength lies in their deep integration with their own hardware and global logistics capabilities.

B. Large System Integrators and MSPs (e.g., CDW, Insight):

They act as agnostic brokers, offering HaaS solutions that can include hardware from multiple manufacturers, tailored to the client’s specific needs. Their value is in customization and integration.

C. Specialized HaaS Providers:

Niche players focus on specific verticals (like healthcare or education) or product categories (like Apple devices), offering highly tailored services and support.

G. The Future Trajectory of Hardware-as-a-Service

The HaaS model is evolving beyond simple hardware subscriptions into a more intelligent, integrated platform.

A. The Integration of AI and Predictive Analytics:

Future HaaS platforms will use AI to predict hardware failures before they happen, automatically trigger replacement devices, and provide deep analytics on device usage and employee productivity patterns.

B. The Convergence with Software-as-a-Service (SaaS):

The line between hardware and software will continue to blur. We will see more bundled offerings where the hardware is optimized to run a specific SaaS application perfectly, with both included in a single subscription.

C. The Expansion into New Hardware Categories:

The model will expand to include specialized hardware like AR/VR headsets, robotics, and advanced medical devices, making cutting-edge technology accessible without prohibitive upfront costs.

D. The Rise of the “Everything-as-a-Service” (XaaS) Workplace:

HaaS will become a core component of a fully subscription-based IT stack, seamlessly integrated with SaaS, NaaS, and security services to create a completely managed digital workplace.

Conclusion: The Inevitable Shift to a Service-Centric IT Model

The growth of Hardware-as-a-Service is a definitive signal of a broader transformation in the business world: the shift from owning assets to consuming outcomes. It represents a more mature, strategic, and financially savvy approach to managing technology. For businesses, the question is no longer if they should consider HaaS, but when and how they will transition. The benefits of financial flexibility, reduced operational complexity, enhanced security, and built-in sustainability create a compelling case that is difficult to ignore. As the technology landscape grows more complex, the ability to offload the burden of hardware management to specialized partners will become a key competitive differentiator. HaaS is not just a procurement trend; it is the foundational model for the agile, resilient, and future-proof enterprise.

![Network as a Service Market Size, Share, Growth & Trends [2030]](https://server.patinews.com/wp-content/uploads/2025/10/network-as-a-service-market.jpg)