Cloud Computing Price Wars and Customer Benefits

Cloud Computing Price Wars and Customer Benefits

The digital universe is expanding at an unprecedented rate, powered by an invisible engine: cloud computing. This technological paradigm shift has moved business operations from physical server rooms to vast, global networks of remote data centers. At the heart of this multi-billion-dollar industry lies a fierce and relentless battle for market dominance, a conflict often manifested in a recurring and dramatic trend—the cloud computing price war. This comprehensive analysis delves deep into the mechanics of these price wars, exploring their historical context, the strategic motivations of the key players, the profound implications for businesses worldwide, and the sophisticated future of cloud cost competition that extends far beyond simple price cuts.

A. The Foundation: Understanding the Cloud Computing Landscape

Before dissecting the price war, one must first understand the battlefield. Cloud computing is the on-demand delivery of IT resources over the internet with pay-as-you-go pricing. Instead of buying, owning, and maintaining physical data centers and servers, businesses can access technology services, such as computing power, storage, and databases, from a cloud provider on an as-needed basis.

The market is dominated by three hyperscale providers, often referred to as the “Big Three”:

A. Amazon Web Services (AWS): The undisputed pioneer and market leader, launching in 2006. AWS offers the most extensive and mature catalog of services, from basic computing to advanced machine learning and analytics tools.

B. Microsoft Azure: A powerful contender that has leveraged its deep-rooted enterprise relationships and dominance in the Windows Server and Office 365 ecosystems to become a formidable second-place player. Its hybrid cloud solutions are a key differentiator.

C. Google Cloud Platform (GCP): Known for its cutting-edge technology in data analytics, artificial intelligence (AI), and machine learning (ML), as well as its expertise in containerization and open-source technologies like Kubernetes. GCP has aggressively competed on price to gain market share.

Beneath these giants exists a tier of other significant players, including IBM Cloud and Oracle Cloud, who compete fiercely in niche enterprise segments. The competitive dynamics between these titans set the stage for continuous price reductions.

B. A Historical Retrospective: The Key Battles in the Cloud Price War

The cloud price war did not erupt overnight; it has been a series of strategic skirmishes and calculated offensives spanning over a decade. Tracking its history reveals a pattern of innovation and aggressive competition.

A. The Opening Salvo (2006-2009): AWS established the market and enjoyed minimal competition, allowing it to set initial price points. The focus was on proving the viability of the cloud model rather than competing on cost.

B. The Escalation Phase (2010-2013): As Microsoft Azure and Google Cloud entered the market more robustly, the first major price cuts began. In 2014, Google fired a massive volley by slashing prices across its core compute and storage services by 30-85%. This move was a direct challenge to AWS’s profitability and market position. AWS responded within days, matching and sometimes exceeding Google’s cuts, with Azure quickly following suit. This period marked the official declaration of a full-scale price war.

C. The Era of Sustained Cuts and New Models (2014-Present): Since the 2014 event, price reductions have become a regular occurrence. The competition evolved beyond simple list-price cuts into more sophisticated pricing models. The introduction of “sustained use discounts” (Google) and “reserved instances” (AWS, Azure) allowed customers to commit to longer-term usage in exchange for significantly lower rates. The launch of “spot instances” or “preemptible VMs,” which sell unused cloud capacity at steep discounts, created a new, price-sensitive market segment.

D. The Modern Arena: A Multi-Front Conflict: Today, the war is fought on multiple fronts simultaneously. While periodic list-price reductions still happen, the primary battles are now waged through complex discounting programs, free tier offerings, and credits for startups. The competition has also shifted towards competing on the value of proprietary services in AI, ML, and data analytics, where direct price comparison is more difficult.

C. The Strategic Drivers: Why Giants Slash Their Prices

For an industry with immense infrastructure costs, the relentless drive to lower prices seems counterintuitive. However, this strategy is driven by several powerful, logical factors that align with long-term business objectives.

A. Acquiring Market Share and Customer Lock-In: The primary goal is customer acquisition. A lower price point is the most effective tool to lure businesses away from a competitor or to capture new, price-sensitive segments like startups and small-to-medium businesses (SMBs). Once a customer migrates their infrastructure and applications to a specific cloud platform, the high cost and complexity of switching to another provider (vendor lock-in) creates a sticky, long-term revenue stream. The initial low price is an investment in a future, loyal customer.

B. The Economics of Scale and Technological Innovation: Hyperscale cloud providers operate at a level that allows for continuous efficiency improvements. As they build more data centers and serve more customers, their fixed costs are spread over a larger revenue base, improving margins. Simultaneously, relentless innovation in hardware—such as custom-designed chips (e.g., AWS Graviton, Google TPU), more efficient servers, and advanced cooling systems—lowers the fundamental cost of providing a unit of computing power. These savings are partially passed on to customers to maintain competitive pressure.

C. The Commoditization of Core Services: Basic compute (virtual machines) and storage services have become increasingly standardized, resembling commodities. When products are perceived as identical, price becomes the primary differentiator. By aggressively cutting prices on these commodity services, providers can attract customers to their ecosystem, where they can then upsell them on higher-margin, differentiated services like managed databases, AI/ML APIs, and Internet of Things (IoT) platforms.

D. The “Razor and Blades” Business Model: Many providers operate on a model similar to selling a razor handle cheaply to sell expensive blades later. They offer core infrastructure at very thin margins or even a loss to onboard customers. The real profitability comes from the ongoing consumption of value-added services, data egress fees, and support contracts that customers inevitably use as they scale their operations.

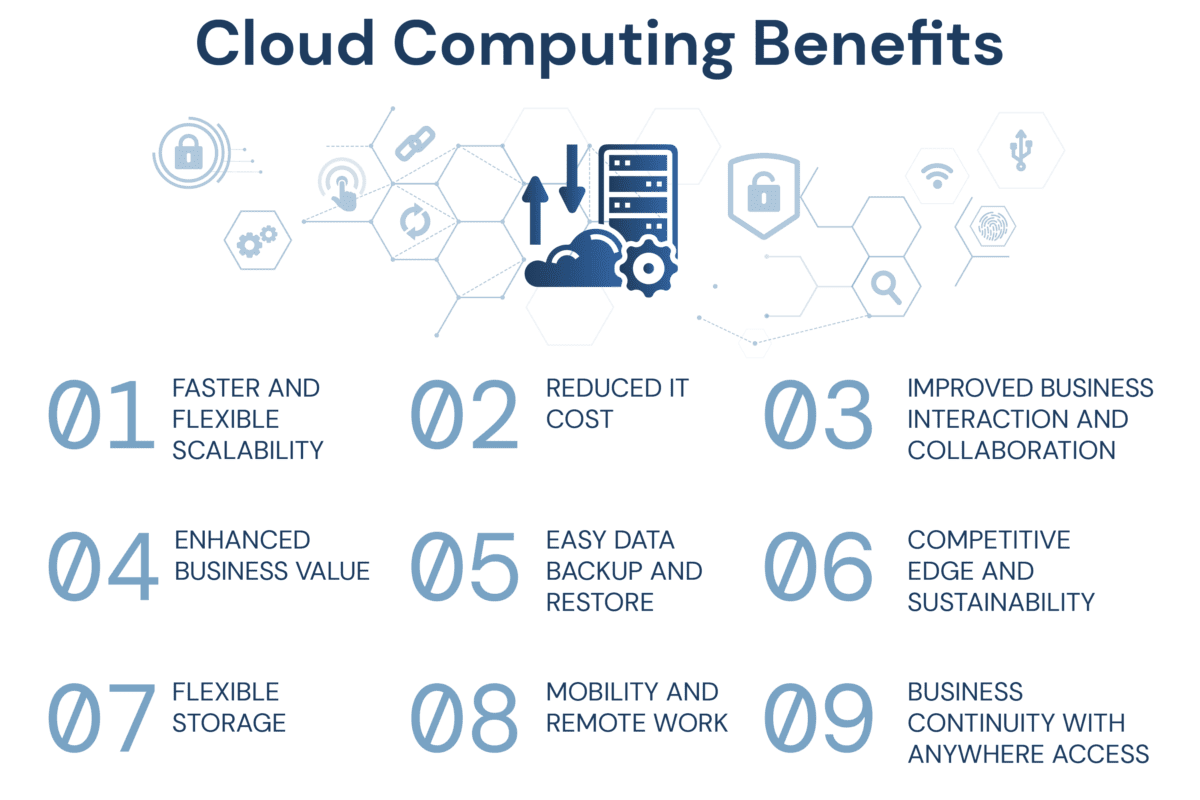

D. The Tangible Benefits: How Customers Win the Price War

The direct and most obvious beneficiary of this corporate conflict is the customer. The price war has democratized access to world-class technology, creating a cascade of positive effects.

A. Dramatic Reduction in IT Costs and Barrier to Entry: Startups today can access the same computing power that once required millions of dollars in capital expenditure for a few hundred dollars a month. This has been a fundamental driver of innovation in the tech industry, enabling entrepreneurs to build and scale global applications without massive upfront investment. Established enterprises can also significantly reduce their data center costs and reallocate capital to core business functions.

B. Accelerated Pace of Innovation and Digital Transformation: With lower costs and easier access to advanced technologies, companies can experiment more freely. They can spin up new environments to test ideas, leverage AI services they couldn’t otherwise afford to build, and deploy applications faster. This fosters a culture of innovation and accelerates the overall pace of digital transformation across all industries.

C. Increased Focus on Cost Optimization and FinOps: The complexity of cloud pricing has given rise to a new business discipline: Cloud Financial Management, or FinOps. This practice brings financial accountability to the variable spend model of the cloud. Companies are now forced to become more sophisticated in their cloud usage, analyzing spending patterns, right-sizing resources, and leveraging the various discount models to maximize their return on investment. This leads to more efficient and financially disciplined IT operations.

D. The Empowerment of the Buyer: In a competitive market, customers hold more power. They can negotiate better enterprise agreements, demand more transparency, and play providers against each other. The competition forces providers to not only lower prices but also to continuously improve their service offerings, support, and global infrastructure to retain happy customers.

E. Navigating the Hidden Complexities and Potential Pitfalls

While the benefits are substantial, the cloud price war and the resulting pricing models are not without their challenges. A low list price does not always translate to a low final bill.

A. The Peril of Complex and Opaque Pricing Structures: Cloud pricing is notoriously complex. With hundreds of thousands of line items, different pricing tiers for different regions, and a myriad of discount options, it is easy for businesses to lose track of their spending. Without careful management and automated tools, costs can spiral unexpectedly, a phenomenon often called “bill shock.”

B. The Risk of Vendor Lock-In Amidst Savings: The very strategies that save money—using proprietary services, committing to reserved instances, and deeply integrating with a single cloud’s ecosystem—can make it prohibitively expensive and technically challenging to migrate to another provider later. The initial savings can be eclipsed by the long-term loss of negotiating leverage and flexibility.

C. The Potential for Erosion of Service Quality and Support: There is an ongoing debate about whether the relentless pressure on prices could, over time, impact the quality of support or the rate of innovation in non-differentiable services. While the major providers have maintained high standards, it remains a consideration for businesses relying on mission-critical applications.

D. The Management Overhead of a Multi-Cloud Strategy: To avoid lock-in and leverage the best prices, many companies adopt a multi-cloud strategy, using services from two or more providers. However, this introduces significant complexity in terms of data management, network configuration, security policies, and the need for specialized skills across different platforms, potentially increasing administrative costs.

F. Beyond the List Price: The Evolving Nature of Cloud Competition

The frontier of the cloud war is shifting. The competition is no longer just about who has the cheapest virtual machine. The new battlegrounds are defined by value, specialization, and ecosystem.

A. Competition Through Value-Added and Proprietary Services: The real margins and differentiation lie in managed services. AWS’s SageMaker for machine learning, Azure’s OpenAI integrations, and Google’s BigQuery for data analytics are examples of high-value services that are difficult to replicate and where customers are less price-sensitive. Winning here means winning the most profitable and strategic customers.

B. The Strategic Importance of Free Tiers and Startup Credits: Providers aggressively court the next generation of businesses. AWS Activate, Google for Startups, and Microsoft for Startups offer substantial cloud credits, technical support, and training. This is a long-term investment in building loyalty with future unicorns from their earliest days.

C. The Rise of Industry-Specific Clouds: Providers are now packaging their services into vertical-specific solutions, such as AWS for Health or Google Cloud for Retail. These offerings combine infrastructure with specialized software and compliance tools, creating a compelling value proposition that transcends simple price comparisons.

D. The Hybrid and Edge Computing Frontier: As computing extends to the edge (e.g., in factories, retail stores, and vehicles), the battle is moving to hybrid solutions that seamlessly connect on-premises infrastructure with public cloud services. Providers are competing on the elegance and power of their hybrid management platforms, like Azure Arc and AWS Outposts.

G. A Strategic Action Plan for Maximizing Cloud Price War Benefits

For businesses, navigating this landscape requires a proactive and informed strategy. Here is a plan to ensure you are a winner in the cloud price war.

A. Conduct a Rigorous and Continuous Cost Assessment: You cannot manage what you do not measure. Implement cloud cost management tools (e.g., AWS Cost Explorer, Azure Cost Management, or third-party tools like CloudHealth or Flexera) to gain full visibility into your spending. Analyze reports regularly to identify waste and optimization opportunities.

B. Master the Art of Commitment-Based Discounts: Do not run your production workloads on standard, on-demand pricing. Develop a strategy for utilizing:

-

Reserved Instances / Savings Plans (AWS/Azure): Commit to a 1 or 3-year term for steady-state workloads for savings of up to 70%.

-

Committed Use Discounts (GCP): Similar to RIs, offering significant discounts for committed spend.

-

Spot Instances / Preemptible VMs: Use these for fault-tolerant, flexible workloads like batch processing, video rendering, or data analysis to save up to 90%.

C. Architect for Cost Efficiency and Elasticity from the Start: Design your applications to be cloud-native. Use auto-scaling groups to automatically add or remove resources based on demand. Choose the right resource types and storage classes for your specific workload. A well-architected system is inherently a cost-optimized system.

D. Cultivate a Culture of FinOps: Make cloud cost accountability a shared responsibility across your development and operations teams, not just a finance function. Educate your engineers on the cost implications of their architectural decisions.

E. Strategically Leverage a Multi-Cloud Approach: While complex, a deliberate multi-cloud strategy can be beneficial. Use it to avoid critical vendor lock-in, to host applications in the region where a specific provider is strongest or cheapest, and to maintain negotiating leverage when renewing enterprise agreements.

Conclusion: The Enduring War and Its Lasting Legacy

The cloud computing price war is a defining feature of the modern digital economy, a powerful force that has fundamentally reshaped how businesses operate and innovate. It is a complex, multi-faceted conflict driven by scale, innovation, and the relentless pursuit of market leadership. For customers, it presents a golden era of accessibility and power, but it demands sophistication, vigilance, and strategic planning to navigate its hidden complexities. As the competition evolves beyond simple price tags towards value, specialization, and global ecosystem dominance, one thing remains certain: the customer who is informed, proactive, and strategically agile will continue to reap the greatest rewards from this ongoing technological revolution.