Global Silicon Shortage Impact Analysis

What began as a temporary supply chain disruption has evolved into a persistent, structural crisis reshaping the global technological and industrial landscape. The ongoing global silicon shortage, more accurately described as a semiconductor crisis, continues to ripple through every sector of the modern economy. From idled automobile factories to year-long waitlists for next-generation gaming consoles and scaled-back corporate IT upgrades, the scarcity of these microscopic silicon chips has exposed the profound vulnerability of our interconnected world. This comprehensive analysis delves into the multifaceted impact of the prolonged silicon shortage, exploring its root causes, sector-by-sector consequences, the strategic responses from industry giants, and the long-term implications for global manufacturing, technology innovation, and economic stability.

A. The Perfect Storm: Understanding the Crisis Origins

The current shortage is not the result of a single event, but a convergence of unprecedented factors that created a “perfect storm” in the semiconductor industry.

A. The COVID-19 Pandemic: A Dual-Edged Sword:

The pandemic acted as the primary catalyst, creating a massive and simultaneous shock to both supply and demand.

-

Supply-Side Collapse: Initial lockdowns forced semiconductor fabrication plants (“fabs”) and supporting component suppliers to shutter or operate at reduced capacity, creating an immediate production deficit.

-

Demand-Side Explosion: Simultaneously, demand for electronics skyrocketed as the world shifted to remote work, online education, and home entertainment. Sales of laptops, webcams, networking equipment, and cloud servers surged, placing immense strain on the already constrained supply.

B. Just-in-Time Manufacturing Meets a Non-Just-in-Time Product:

The automotive industry’s highly efficient, lean inventory model proved disastrously incompatible with semiconductor production realities.

-

Cancelled Orders: When car sales plummeted early in the pandemic, automakers cancelled their chip orders.

-

Inability to Ramp Back Up: When demand recovered faster than anticipated, they found their place in the queue had been taken by the booming consumer electronics industry. Semiconductor fabs, which operate on lead times of 12-24 months, could not simply flip a switch to restore supply.

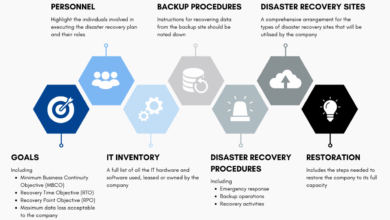

C. Geopolitical Tensions and Trade Restrictions:

The U.S.-China tech war created significant friction in the global supply chain.

-

Sanctions on Chinese Tech Firms: Restrictions on companies like Huawei led to stockpiling and aggressive pre-ordering, further straining global capacity.

-

National Security Concerns: Policies aimed at bringing chip manufacturing onshore have disrupted long-established, efficient global trade flows for semiconductors.

D. Structural Underinvestment in Mature Node Capacity:

The shortage has been most acute for mature “legacy” nodes (28nm to 180nm), which are essential for automobiles, industrial equipment, and home appliances. While investment has poured into leading-edge nodes (5nm, 3nm) for advanced CPUs and GPUs, the less-profitable mature nodes saw underinvestment, creating a critical bottleneck for a vast range of essential products.

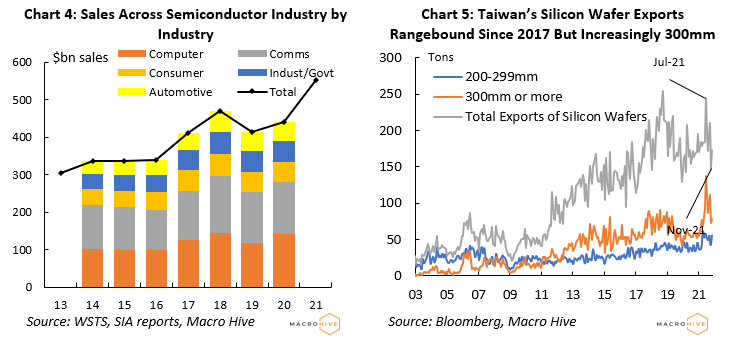

B. Sectoral Shockwaves: A Detailed Impact Analysis

The silicon shortage has indiscriminately impacted nearly every industry, though some have felt the pain more acutely than others.

A. The Automotive Industry: Ground Zero of the Crisis:

The automotive sector has been the most visible victim, with impacts far beyond delayed deliveries.

-

Production Halts and “Feature Deletion”: Manufacturers have repeatedly idled assembly lines, costing the industry an estimated $210 billion in lost revenue in 2021 alone. Many have resorted to shipping vehicles without certain high-tech features like heated seats, premium sound systems, or even fuel management modules, with promises to install them later.

-

Shift in Supplier Power: Traditional automakers, once the dominant partners in their supply chains, now find themselves pleading for allocation from chipmakers, fundamentally altering long-standing business relationships.

-

Accelerated Vertical Integration: In response, companies like Ford and General Motors are now striking direct deals with chip foundries and designing their own proprietary silicon to secure future supply.

B. Consumer Electronics: Delayed Launches and Soaring Prices:

While better positioned than automakers due to their larger volumes and closer relationships with foundries, the consumer electronics industry has faced significant challenges.

-

Extended Product Lifecycles: Companies have been forced to extend the life of existing models due to an inability to secure components for new designs.

-

Scalper Markets and Inflation: High-demand items like PlayStation 5, Xbox Series X, and latest-generation GPUs have been plagued by limited stock, fueling a rampant reseller market and driving consumer prices to unprecedented levels.

-

Supply Chain Diversification: Manufacturers are now diversifying their supplier base beyond traditional partners, accepting higher costs for greater security.

C. Enterprise IT and Data Center Expansion:

The backbone of the digital economy has also been constrained.

-

Server Lead Times: Lead times for new servers have stretched from weeks to over a year for some configurations, delaying corporate digital transformation projects and cloud data center expansions.

-

Networking Equipment Shortfalls: Critical infrastructure like switches, routers, and Wi-Fi access points have been in chronically short supply, hampering network upgrades and the rollout of new office setups.

-

Rising Cloud Costs: Hyperscale cloud providers, while somewhat insulated by their massive purchasing power, face higher costs for their underlying infrastructure, a cost that is inevitably passed on to consumers over time.

D. Industrial and Internet of Things (IoT) Applications:

The “hidden” impact has been on the industrial and IoT sectors, which rely on mature-node chips.

-

Factory Automation Delays: The rollout of smart manufacturing and Industry 4.0 initiatives has been slowed due to a lack of sensors, controllers, and embedded processors.

-

Medical Device Manufacturing: Production of everything from pacemakers to MRI machines has been impacted, posing potential risks to public health infrastructure.

-

Smart Home Product Delays: New and existing smart home devices have seen limited availability and increased prices.

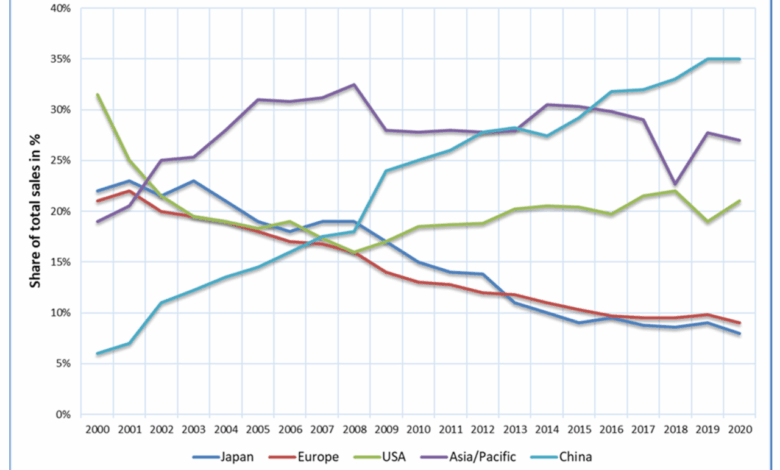

C. The Global Response: Strategic Shifts and Long-Term Solutions

The crisis has triggered a fundamental re-evaluation of global semiconductor strategy, involving massive capital investment and geopolitical maneuvering.

A. Unprecedented Capital Expenditure in New Capacity:

The industry is responding with historic levels of investment.

-

TSMC’s Global Footprint: The world’s leading foundry is investing over $100 billion in new capacity, including a massive $40 billion fab in Arizona, USA, and expansion in Japan.

-

Intel’s IDM 2.0 Strategy: Intel is committing $80+ billion to build new fabs in Europe and the U.S., revitalizing its foundry business to compete with TSMC and Samsung and provide a geographically diverse supply source.

-

Samsung and GlobalFoundries: Other major foundries are also announcing multi-billion-dollar expansions to increase global capacity across both leading-edge and mature nodes.

B. Government Intervention and Policy Initiatives:

Recognizing semiconductors as a strategic resource akin to oil, governments are taking action.

-

The CHIPS for America Act: The U.S. has passed $52 billion in funding to subsidize domestic semiconductor research and manufacturing.

-

European Chips Act: The EU is mobilizing over €43 billion in public and private investment to double its global market share by 2030.

-

Geopolitical Realignment: Nations are actively forming “chip alliances” to secure friendly and resilient supply chains, reducing reliance on geopolitically tense regions.

C. Corporate Supply Chain Transformation:

Companies are overhauling their supply chain philosophies.

-

From Just-in-Time to “Just-in-Case”: Businesses are building strategic buffer stocks of critical components, accepting higher inventory carrying costs for greater supply certainty.

-

Long-Term Supplier Agreements (LTAs): Customers are increasingly signing multi-year, non-cancellable purchase agreements with chipmakers to guarantee future allocation, even at a premium.

-

Increased Supply Chain Visibility: Investments in digital supply chain platforms are becoming essential, allowing companies to gain real-time visibility into their sub-tier supplier networks to anticipate disruptions.

D. The Road to Recovery: A Protracted and Uneven Path

Despite these massive efforts, a return to pre-pandemic normalcy is not imminent. The recovery will be long, complex, and uneven.

A. Persistent Lead Times and Allocation:

Even with new fabs under construction, supply will remain tight for the foreseeable future. Building a new semiconductor fab is a multi-year process, with lead times of 2-4 years from groundbreaking to production. Allocation—where suppliers decide which customers get scarce chips—will remain a key business dynamic.

B. Structural Inflation in Electronics:

The era of consistently falling electronics prices is likely over, at least temporarily. The massive capital expenditures for new fabs, coupled with higher costs for materials, energy, and transportation, will result in structurally higher chip prices that will be passed through the entire value chain.

C. A Reshaped Competitive Landscape:

The crisis will create winners and losers.

-

Winners: Companies with strong balance sheets that can afford long-term agreements and strategic inventories; semiconductor capital equipment companies; and foundries with diversified global manufacturing.

-

Losers: Smaller manufacturers without the purchasing power to secure supply; industries that rely on low-margin, high-volume mature nodes; and consumers, who will face higher prices and limited choices.

Conclusion: A New Era of Strategic Resilience

The global silicon shortage has served as a brutal but necessary stress test for the interconnected global economy. It has shattered the illusion that complex supply chains are inherently efficient and resilient. The crisis has forced a painful but essential reckoning, demonstrating that foundational technologies like semiconductors cannot be treated as mere commodities. The path forward is not about simply returning to the old normal, but about building a new, more resilient paradigm characterized by strategic redundancy, geographic diversification, and deeper collaboration between governments and industry. The silicon shortage is more than a supply chain story; it is a pivotal moment that is redefining global economic security, technological sovereignty, and the very architecture of how we build the modern world. The lessons learned from this prolonged crisis will shape corporate strategy and national policy for decades to come, ensuring that the humble silicon chip remains recognized as the bedrock of 21st-century progress.